Amendments in the FEMA, 1999

RBI Updates January 2024

1. Amendment to the Master Direction - Know Your Customer (KYC) Direction, 2016

The Master Direction on KYC has been amended to align with recent changes in regulatory frameworks. These amendments apply to the processes of Customer Due Diligence (CDD) and information handling.

- Customer Due Diligence (CDD) Procedures:

- Regulated Entities (REs) must conduct CDD at the Unique Customer Identification Code (UCIC) level.

- Existing KYC-compliant customers do not need to undergo fresh CDD when opening additional accounts or accessing other products/services at the same RE.

- High-Risk Accounts Monitoring:

- Clarification that high-risk accounts should undergo intensified monitoring. The context for this has been appropriately relocated within the regulation.

- Periodic KYC Updating:

- The term “periodic updation” has been added for better clarity concerning when KYC information should be updated.

- KYC Records Management with Central KYC Records Registry (CKYCR)

- REs are required to upload and update KYC data for individual customers and legal entities at periodic intervals or when new information is obtained.

- Once updated, all reporting entities who have dealt with the concerned customer will be notified electronically about the changes.

- KYC Identifier Usage:

- For establishing account-based relations and for verification, the REs will retrieve the KYC Identifier from the customer or CKYCR instead of requiring customers to submit KYC records again, except under specific conditions (e.g., changes in customer information).

- Designation Changes:

- The designation of the Central Nodal Officer for the Unlawful Activities (Prevention) Act (UAPA) has been updated from “Additional Secretary” to “Joint Secretary.”

The link to the aforesaid Circular is as follows:

https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NOTI87296ED881E788420F971BE7ACDD35EAFE.PDF

2. ‘Fully Accessible Route’ for Investment by Non-residents in Government Securities – Inclusion of Sovereign Green Bonds

- Vide: RBI/2024-25/88 – FMRD.FMD.No.06/14.01.006/2024-25

- Dated: November 07, 2024

- Introduction of Sovereign Green Bonds under the ‘Fully Accessible Route’FAR List: Sovereign Green Bonds of 10-year tenor issued by the Government for the second half of the fiscal year 2024-25 have been designated as ‘specified securities’ under the FAR for non-resident investors.

- Fully Accessible Route (FAR): The FAR was introduced by the Reserve Bank of India (RBI) on March 30, 2020, allowing specified categories of Central Government securities to be available for non-resident investors without restrictions.

- Eligibility for Investment: The circular specifies that certain government securities are available for investment by both non-resident and domestic investors, without restrictions.

The link to the aforesaid Circular is as follows:

https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NOTI8807112024C5A8965FF08349948FBE92259CD2CD51.PDF

3. Reporting of Foreign Exchange Transactions to the Trade Repository

- Vide: RBI/2024-25/89 – FMRD.MIOD.07/02.05.002/2024-25

- Dated: November 08, 2024

- Reporting Requirement Expansion:

- Authorised Dealers must report all over-the-counter (OTC) foreign exchange derivative contracts and foreign currency interest rate derivative contracts.

- The requirement now includes foreign exchange spot, tom, and cash deals.

- Types of Transactions to be Reported:

- Foreign exchange cash

- Foreign exchange tom

- Foreign exchange spot

- Reporting Timelines for Inter-Bank FX Contracts:

- Contracts involving INR: Report in hourly batches within 30 minutes of the completion of the hour.

- Contracts not involving INR: Must be reported by 5:30 p.m. for contracts executed by 5 p.m.; otherwise, the next business day by 10 a.m.

- Reporting Timelines for Client FX Contracts:

- Contracts equal to or exceeding USD 1 million must be reported by May 12, 2025.

- Contracts equal to or exceeding USD 50,000 must be reported by November 10, 2025.

- Client transactions should be reported before 12 noon of the following business day.

- Transaction Matching:

- There is no requirement for matching transactions with overseas counterparties or clients.

- Accuracy and Reconciliation:

- Authorised Dealers are responsible for ensuring the accuracy of reported transactions.

- They must reconcile outstanding balances with the Trade Repository and conduct ongoing audits.

- Submission Formats:

- Reporting formats will be specified by the Clearing Corporation of India Ltd. (CCIL), with prior approval from the Reserve Bank of India.

- Authority:

- The directions are issued under the powers of the Reserve Bank of India as stipulated under the Reserve Bank of India Act, 1934, and the Foreign Exchange Management Act, 1999.

4. Operational framework for reclassification of Foreign Portfolio Investment to Foreign Direct Investment (FDI)

- Vide: RBI/2024-25/90/A.P. (DIR Series) Circular No. 19

- Dated: November 11, 2024

- Regulatory Background:

- The reclassification framework is based on the Foreign Exchange Management (Non-debt Instruments) Rules, 2019.

- Investment Limit:

- FPIs must hold less than 10% of the total paid-up equity capital (fully diluted) of a company. If this limit is breached, FPIs can choose to divest or reclassify their investment as FDI.

- Conditions for Reclassification:

- The reclassification is not allowed in sectors where FDI is prohibited.

- FPIs must secure necessary government approvals and the concurrence of the Indian investee company before acquiring equity above the prescribed limit.

- Process of Intent:

- FPIs must clearly articulate their intent to reclassify their investment, provide necessary approvals to their Custodian, and temporarily freeze further purchases until reclassification is complete.

- Reporting Requirements:

- The reclassification must be reported within specified timelines:

- Form FC-GPR for fresh issuance of equity instruments.

- Form FC-TRS for secondary market acquisitions.

- AD banks will report the amount of reclassified investment as divestment under the LEC (FII) reporting.

- The reclassification must be reported within specified timelines:

- Custodian Role:

- After reporting completion, the FPI asks its Custodian to transfer equity instruments from its foreign portfolio investment account to its FDI account. The date of investment breach is considered as the reclassification date.

- Post-Reclassification:

- Once reclassified, the investment is deemed FDI, even if holdings later drop below 10%. The FPI and its investor group are treated as a single entity for reclassification purposes.

- Completion Timeline:

- Reclassification or divestment of holdings must be completed within the prescribed timeframe as per the regulations.

5. RBI re-defines ‘Startup’ vide Foreign Exchange Management (Foreign Currency Accounts by a Person Resident in India) (Fourth Amendment) Regulations, 2024...

The Reserve Bank of India (RBI) on November 19, 2024, issued the Foreign Exchange Management (Foreign Currency Accounts by a Person Resident in India) (Fourth Amendment) Regulations, 2024, to further amend the Foreign Exchange Management (Foreign Currency Accounts by a Person Resident in India) Regulations, 2015.

By way of the amendment, the explanations to Regulation 5 and para 1 (vii) of Schedule I in the 2015 Regulations have been substituted to provide that a ‘startup’ will mean an entity that is recognized as a startup by the Department for Promotion of Industry and Internal trade as per Notification number G.S.R. 127(E) dated 19-02-2019

Synopsis

This was introduced to simplify authorized dealers to allow the opening of foreign currency bank accounts of recognized start-ups. The amendments were made after the definition of startups was changed to include entities up to 10 years from five years before the date of incorporation with a higher turnover threshold of Rs 100 crore as against Rs 25 crore earlier.

The amended Foreign Exchange Management Regulations 2024 simplify opening foreign currency accounts for DPIIT-recognized startups, aligning with the extended definition of startups (10 years, ₹100 crore turnover). The RBI also permits non-residents to hold interest-bearing accounts in INR or foreign currency.

IMPORTANT PRESS RELEASES

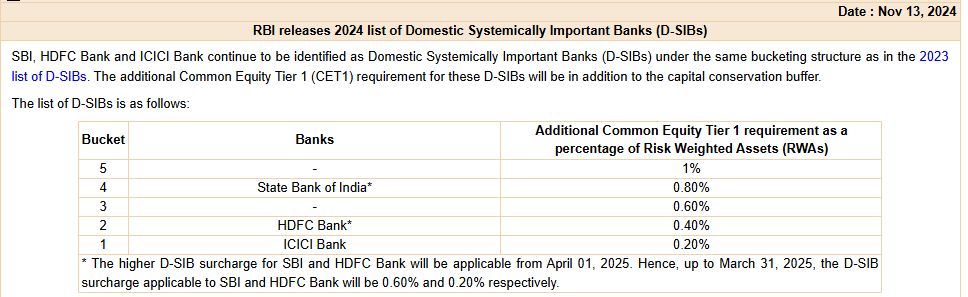

1. RBI releases 2024 list of Domestic Systemically Important Banks (D-SIBs)

The link to the aforesaid press release is as follows:

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR1490B7B260EF5BAA403888462A4A6C6A5F7A.PDF

IMPORTANT PRESS RELEASES ON PENALTY LEVIED BY RBI

(CONSIDERED CASES WHERE PENALTY EXCEEDS 5 LAKHS)

1. RBI imposes monetary penalty on Shree Mahabaleshwar Co-operative Bank Ltd., Karnataka

Reason:

The bank had conducted:

- non-complied with certain directions issued by RBI on ‘Loans and advances to directors, their relatives, and firms /concerns in which they are interested’.

- This action is based on deficiencies in regulatory compliance and is not intended to pronounce upon the validity of any transaction or agreement entered into by the bank with its customers

Amount

₹5.00 lakh (Rupees Five lakhs only)

The link to the aforesaid press release is as follows:

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR1447261A581329034561997D1D6989F0CD29.PDF

2. RBI imposes monetary penalty on South Indian Bank Limited

Reason:

The bank had

- Non-complied with certain directions issued by RBI on ‘Interest Rate on Deposits’ and ‘Customer Service in Banks’.

- The levied penal charges for non-maintenance of minimum balance / average minimum balance without notifying certain customers by SMS/email/letter, etc.

- Marked lien against certain NRE savings deposit accounts.

Amount

₹59.20 lakh (Rupees Fifty-Nine Lakh and Twenty Thousand only)

The link to the aforesaid press release is as follows:

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=59063

3. RBI imposes monetary penalty on The Jaynagar Mozilpur People’s Co-operative Bank Ltd., West Bengal

Reason:

The bank had:

- Non-complied with RBI directions on Priority Sector Lending (PSL) targets and classifications.

- Failure to contribute to the Micro and Small Enterprises (MSE) Refinance Fund due to a shortfall in PSL achievements for the Financial Year (FY) 2022-23.

Amount

₹6.34 lakh (Rupees Six Lakh Thirty-Four Thousand only))

The link to the aforesaid press release is as follows:

https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR1511AC139E373ABB43B1A27540A9A129C675.PDF