360 Degree View- Watch around

360 Degree View may 2024

1. All eyes on India for the Data Centre

Observers are saying that MNCs opt for India to expand operations and relocate from other markets.

The country’s Data Center (DC) capacity is expected to cross 1,800 megawatts (MWs) by the end of 2026, with the country likely to record an additional capacity of 850 MW during 2024-26, according to a report by real estate consultancy CBRE South Asia.

According to the CBRE report, India has the highest DC capacity of around 950 MW in the Asia-Pacific regions (excluding China). After India, Japan recorded the second-highest DC capacity with 892 MW, followed by Australia at 773 MW, Singapore at 718 MW, Hong Kong at 613 MW, and South Korea at 531 MW”, the report added.

A rapidly growing economy, a widening customer base, improving infrastructure, and increasing internet penetration have given an impetus to the Data Centre (DC) industry in India. DCs are now a leading alternative real estate segment in India and are increasingly attracting the interest of leading global and domestic players.

M & A activity among operators is likely to pick up in the coming years due to the growing number of players, which may result in consolidation.

2. Concern of funds at the growth stage by women-led startups

Venture Capital (VC) funding for women start-ups fell from 14.7% in 2021 to 9.3% in 2023.

Women founders and investment executives find the gap in funding for women-led start-ups at the growth stage. After the initial cheques, growth funding is hard to come which is the reason we see less number of Unicorns being headed by women founders.

Nupur Garg, the founder of Winpe, a not-for-profit organization, said that all investors say they will back the best idea, but that is influenced by stereotypes and unconscious biases. She further added that Male Founders are asked by VCs how fast they can grow the business and how much they can grow in one year, Women founders are asked if they are married, have kids, what their husbands do, what time they go home, other commitments and if they are sure that is not lifestyle business for them.

KPMG Report on Women Leadership in Corporate India 2024 (kpmg.com)

Suneeta Reddy, Managing Director of Apollo Hospital Group mentioned in the KPMG Report that the challenges women face are multifaceted. Deep-rooted social conditioning steers girls away from leadership aspirations, and work-life balance remains a constant struggle. Societal expectations disproportionately burden women with childcare and domestic duties. This is followed by unconscious biases at the workplace and a lack of robust mentorship programs which further impede their rise.

She further gave the profound message that young women of today aspiring to lead in the corporate world need to realize that self-belief is paramount. Embracing their ambition and charting their own course will give them a head start. Building a robust network, both within and outside the organisation with a strong mentorship serves as a valuable support system. Women must understand the importance of speaking up and being assertive at the table. As they grow and succeed, they become a role model for the next generation of women leaders.

Key findings of the survey done by KPMG show that 56% of organisations have only 10 to 30% of women in leadership positions, while 9% of organisations lack any female leaders. This highlights the need for greater diversity promotion in leadership roles.

Mr. Sunil Kant Munjal from Hero Enterprise gave his views stating that when a work culture gives women space, values their diverse perspectives, and salutes their talents, it kicks off a virtual cycle that spawns creativity, enhances problem-solving and increases adaptability. It also provides a competitive edge in a tough and volatile business landscape. Companies around the world with the most diverse workforces outperformed those with the least diverse workforces in terms of return on assets.

Championing diversity as a policy might make sound business sense, yet for this policy to be truly effective, it must cut ice with men themselves. Men must be made to realize and appreciate that an inclusive work culture is in their interest. Once they buy into an environment where they intrinsically and instinctively learn to empower, support, and respect women, they (men) can reduce some of the pressure that they place upon themselves. Equally important, as women gain confidence in their abilities, they too feel encouraged to innovate, adapt, and inspire other women around them.

3. Surge in the formation of LLPs then Companies

As per MCA data in 2023-24 total of 185,314 companies were formed and a total of 58,990 LLPs were formed. India will continue to be the world’s fastest-growing economy this year.

This year in the 1st month of FY 2024-25 there are 15,982 companies were formed compared to 16,599 companies in last April 2023, and a total of 5896 LLPs were formed in April 2024 compared to 4335 in April 2023.

Registration of LLPs is increasing, this may be due to a lesser compliance burden on LLPs. However, days are not far that LLPs may also be governed like Companies as we have seen many provisions of the Companies Act 2013 made applicable to the LLPs, and as per Section 79 of the LLP Act 2008, the Central Government has the power to make the rules for LLPs.

4. Investment in SPACs is not under the Automatic Approval route for Overseas Investment by Resident Indians

SPACs are Special Purpose Vehicles that are formed to raise capital by inviting investors in pre-listing offerings with the sole aim of acquiring a stake in an existing, primarily unlisted operating company. Later the target operating company can merge with the publicly traded SPAC and become a listed entity on large bourses like the New York Stock Exchange.

SPACs became popular in 2019-20 and many HNI Indian Residents have invested in shares of SPACs which are not permitted as per RBI regulations on Overseas Direct Investments (ODI). ODI Regulation permits investments by any entity in a company with business and operations and not a company like SPACs which do not have any operating business. Since August 2022, RBI has shared Dos and Don’ts and prohibited investment by resident Indians in SPACs.

Liberal Remittance Scheme (LRS) limits remittance overseas by Resident Indians to a maximum of 250,000 $ in a year. However, remittance for investment in SPAC is a grey area and it is not covered under the automatic route for overseas investments by resident Indians.

5. Xurbian Revolution

In the Economic Times, a wonderful article was published, written by Ms. Geetanjali Kirloskar, Chairman and Managing Director, Kirloskar Systems, which makes so much sense while we all are talking about “Vikshit Bharat”.

India is on the move. The key issue is to sustain this momentum. India has a young and rapidly growing population – a potential demographic dividend.

In her article, she quoted a Report published in the year 2010 by McKinsey Global Institute (MGI) on” India’s Urban Awakening: Building inclusive cities, sustaining Economic Growth”.

New research by MGI estimates that by 2030 cities could generate 70% of net new jobs, produce more than 70% of Indian GDP, and drive a nearly fourfold increase in per capital incomes across the Nation.

The cost of not paying attention to India’s cities is enormous. Today’s policy vacuum risks worsening urban decay and declining quality of life for citizens

The report mentions that by 2030,

- India’s Urban Population will be 590 MN (39% of the total population)

- There will be 13 Tier 1 cities, 55 Tier 2 cities, and 6000 Tier 3 and Tier 4 cities.

- 5 billion sq Mt of roads will have to be paved

- 7400 Km of Metros and Subways will need to be constructed

These 6000 Tier 3 and Tier 4 cities will need to fuel India’s transformation into a developed country. Indian cities must spend 1.2 trillion over the next two decades and resources to be allocated to tier 3 and 4 cities is $820 BN over the next two decades. This amount is to be used in building schools, hospitals, community centers, and green spaces, primarily through PPP, while attracting private investment in factories, service businesses, and agricultural processing. If carried out, there is no reason to believe that India can’t become the only developed country in the world with over 50% of its population rural, but well connected to the modern and tech-driven world through a network of urban towns and equally productive.

Xurbian Towns would

- Offer citizens quality of life, equal economic opportunities, education, medical, cultural and entertainment facilities

- Be within a 1-2 hours ride from Tier 3-4 towns, which offers children and youth excellent education, training, and quality health sector

- Have at least one modern manufacturing facility and R & D Unit

- Have at least one unit for processing and packaging agricultural produce

- Have central green space and sports facilities

With such a Xurbian Revolution, talent will be widespread and more accessible to growth leading to economic boon spread equally across the country.

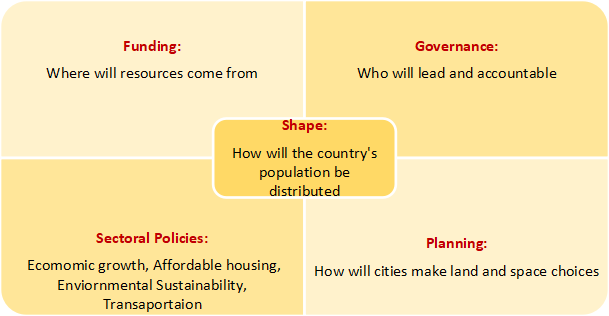

To achieve this goal, India has to chart its journey by learning from other countries and cities of the world. MGI Report shows that different countries and cities have approached their urban development where the following five dimensions are crucial.

6. Class Action Suit against Jindal Poly Films Limited

The Company Jinal Poly Films Limited, questioned the maintainability of the Class Action Suit filed by minority shareholders before the NCLT. The Counsel appearing for the Company said in the Class Action Suit, one needs to show that loss is caused to him, the Petitioner, and has to be compensated by the Company.

7. What is Finternet

Multiple Financial ecosystems interconnected with each other is called the Finternet.

This system has been proposed by Carstens, who is the General Manager of the Bank for International Settlements (BIS), and Mr. Nandan Nilekani, Co-Founder of Infosys, through a recent working paper of BIS.

Carstens said that we foresee a system in which individuals and businesses could transfer any financial assets, in any amount, at any time, using any device, to anyone else, anywhere in the world. Financial transactions would be cheap. Secure and near instantaneous and they would be available to anyone. This proposed system uses technologies such as tokenization and unified ledger, with an underlying economic and regulatory framework. Another key feature in the framework is that Central Banks would remain at the core of the system, ensuring trust in money but working closely with commercial banks. To get simplicity, one must do many complex things where technology helps, he said.

The Finternet, much like the Internet can be made available to Eight Billion people and 300 million businesses if it is universal.

8. Pre-pack Insolvency a Success for 5 Companies

The Government of India enacted the Insolvency and Bankruptcy Code in August 2021 and introduced the Pre-packaged Insolvency Resolution Process (PPIRP) for micro, small, and medium enterprises. PPIRP involves the debtor and its creditors negotiating and agreeing on a resolution plan before initiating the formal insolvency process. Once approved by the creditors, the PPIRP plan is submitted to the National Company Law Tribunal (NCLT) for approval. The PPIRP process is initiated voluntarily by the debtor and since the plan is negotiated and finalized before filing with NCLT, it is time effective.

PPIRP has resulted in the full settlement of operational creditors’ claims of 5 Companies namely Amrit India, Sudal Industries, Shri Rajasthan Syntex, Enn Tree International, and GCCL Infrastructure and Projects leading to fair and equitable treatment.